Social Security? Well... I'm eligible .. but..

Monday Morning Chief busted my Balls on my birthday with "Happy Birthday. Just think, you’ll eligible to draw social security now! Welcome to the old bastard club." Now, it's obviously in humor and I busted his balls back .. but... he had a point. One of my brother-in-law's recently initiated his at 62. My buddy who retired last week imitated his at 62. Now, his wife whom also just retired waited much longer since she was older than him still working and they both retired simultaneously. When I'm doing my 'retirement financial calculators' they always ask for the date I'll start withdrawing and sometimes I put in 62.. sometimes 65.. but up until yesterday when I made a joke about it and many of my buddies whom are withdrawing chimed in .... I had zero clue. I've never seriously looked into it. All I knew before yesterday was 62 was the earliest and you are supposed to by somewhere around the age of 70 no matter what. I knew there was a penalty of sorts in there somewhere if you still worked. But .. otherwise, I'm still working. I don't 'need' the money right now. But at the same time aware sometimes it makes sense to take it out earlier, especially if you don't think you'll be around for a 'long' time?

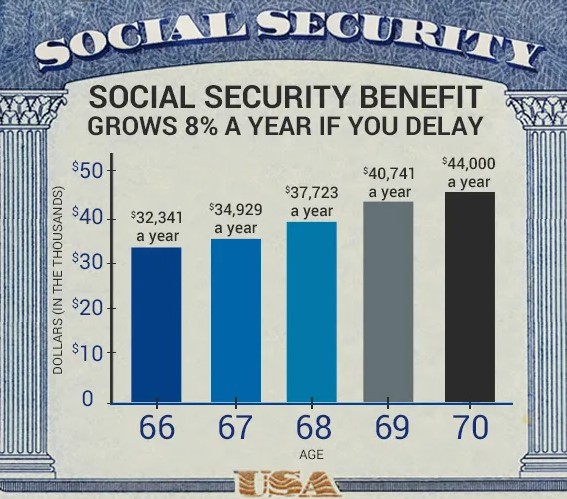

Few of the things that got thrown my way yesterday on Social Media by some of my friends.

Do the Math. How much will you actually lose by waiting 8 years. Guvment Math.

Ha! I have doubts on whether I or SS will still be around in ten years ... yeah I did the math but being a pessimist I don't think I'll live forever and waiting means I think the govts ability to manage money will be successful. Let's just say I'm skeptical

have heard the gain is not worth the wait

Do the math NOW, you might be pleasantly surprised (I know I was) the problem is you will work harder retired than YOU do now!!!

85% of your social security will be taxed, possibly moving you into a higher tax bracket.

f you are the primary wage earner and you wait till 70 to start taking SS and you die, your spouse can receive your higher benefit for the remainder of her life.

If you plan on working for the next 3 years, the math will let the gov tax you and you'll see little benefit.

Definitely don’t take SS if you plan to continue working

I took Steve’s early and they did not tell me it would be certain amount for the rest of my life till it was said and done. Now he worked his butt off all his life and I only get not even half for his life. That is MESS!!!!

Rather have 75 percent for 20 years than 100 percent for 5 years.

So here I am 24 hours later and have done a ton of 'searches' and got advice, much further ahead on the situation What do I know as I type this sentence right now?

Age 67 is the full retirement age for SS. If I am working currently (which I am), I'll lose a percentage of that SS (up to 30%) and get taxed on 85% of it. I don't even have to do the math here. Oh hell no. So as long as I'm currently employed and making 'full time wages' this isn't an option. Note. The max amount they look at is $147,000 annually. If you make that, you are paying in max.

At age 67 even if I'm working and I take it, I don't get dinged. So one would assume it's a no brainer to take it at 67 right? Well ... I think so. But if one holds on until 70, they get plus'd up even more for waiting. Now the kicker is ... if one kicks the bucket early vs later, they left money on the table; potentially lots of money.

Another thing I didn't realize is my spouse gets my SS (which is higher than hers since she has paid taxes vs employment the last twenty year) if I fall by the wayside first. She does 'best' if I wait longest. We both assume she will outlive my ass. So I sort of look at this as an insurance policy for her, which wants me to wait as long as possible?

As I said, I did a lot of searching yesterday. Came up with a lot of the standard info, most of which I've never really read prior to now. Never really cared. I mean.... over the last few decades, wondered if this program would still exist?

My plan to really add to the blog was a full blown spreadsheet of what I'd get monthly at 62/65/67/70. What is that annually? Then show those numbers side by side. The 'huge' growth differences. But as I come to this point... why? I'm NOT going to do SS at 62. I'm not sure I'll do it at 65 now... probably 67 as a minimum .. and at that point... decide at what point between 67-70.

Now for the wife's situation .. that's an interesting option? That's a whole diff' subject. She turns 62 next year. She's been 'retired' for twenty years. Since we file joint for taxes does she get affected early with penalties? Should she draw hers early? Hmmmm... Her's is triple digit numbers, not 4 digits. But it's a matter of principal. I don't see myself asking that question to my FB buddies. I'll save that one for my Tax Preparer.

I sympathize Brother! The more I read the more I have questions. I set down l with my Financial Advisor and he gives me a dozen options and I stare at him like he was speaking a foreign language. WTF!

ReplyDeleteIt's a bunch of BullPussy...I guess one morning I'll say f**k and retire at that point.

Oh .. Happy Birthday!... I'm 30 days older than you.Who

ReplyDeleteknew I would get this far...lol

Thanks for the "Happy Birthday" ... still in disbelief we are at this age point. Seems surreal for multiple reasons. Now, just need to make the dollars last in case we do .. for MANY years!?!?! :)

ReplyDeleteSpeaking work one of my financial advisors yesterday. I said"five mere years" I'll retire. I felt okay saying that. Five....that's nothing in the big picture.

ReplyDelete